In a recent Coach Yu Show, I invited Sean Hurdle, a licensed financial coach who works with individuals, families, entrepreneurs, and small business owners to develop a financial strategy to achieve their financial goals.

Table of Contents

Sean Hurdle’s Reflection: A Lifesaving Experience that Shaped His Values

In Sean Hurdle’s life, a pivotal moment during his childhood significantly influenced his perspective on giving and sacrifice. When he was around seven or eight years old, a pool party at his home took an unexpected turn. Amidst the commotion, he witnessed his parents bravely come to the rescue of a young girl in distress, potentially saving her life.

This profound incident left an indelible impression on Sean. Despite the challenging circumstances and the presence of bodily fluids, his parents selflessly acted to ensure the safety and well-being of another human being. The young girl, as Sean later discovered, was under the care of his uncle, highlighting the importance of foster families and their dedication to nurturing vulnerable children.

The impact of this experience resonates deeply with Sean and has shaped his core values. The selflessness and willingness to help others that he witnessed in his parents have become guiding principles in his own life. The compassion and generosity displayed during that fateful moment continue to inspire him to make a positive difference in the lives of those around him.

Empowering Families with Financial Expertise

In his pursuit of assisting individuals in navigating complex financial decisions and life transitions, Sean Hurdle stumbled upon a training session that introduced him to a revolutionary financial product. The concept resonated deeply with him as he envisioned himself as someone who could provide invaluable support to families seeking guidance on retirement planning and other intricate financial matters.

While the titles of CEO and CFO are widely recognized, Sean noticed a missing piece in many families’ lives—a trusted advocate working behind the scenes. Inspired by this realization, he began embracing the notion of a “family office.” The term held a certain allure, almost like a well-kept secret exclusive to the affluent. Wealthy individuals often have the privilege of accessing family offices and leveraging the expertise of tax advisors to optimize their financial affairs.

Driven by a desire to democratize this advantage, Sean embarked on a mission to establish his own version of a family office—an inclusive and accessible resource that would empower families from all walks of life. With a focus on providing comprehensive financial guidance and support, Sean seeks to bridge the gap between complex financial landscapes and everyday people, ensuring they receive the assistance they deserve.

Drawing upon his newfound inspiration, Sean Hurdle continues to champion the importance of having a dedicated advocate in one’s corner, guiding families toward financial prosperity and helping them make informed decisions. Through his family office approach, he aspires to unveil the hidden advantage and empower individuals and families to achieve their financial goals with confidence and peace of mind.

Unveiling Financial Opportunities for Everyday Individuals

When discussing the lesser-known aspects of personal finance, Sean Hurdle sheds light on a couple of crucial areas that often go unnoticed by the average person.

One of these key factors revolves around the potential tax advantages that individuals can leverage, particularly in light of the current trend known as the great resignation. As more people venture into entrepreneurship or freelance work, there are significant tax benefits associated with establishing an LLC or embracing a solo entrepreneurial path. Sean’s own wife recently embarked on a freelance journey within the mental health therapy realm, experiencing firsthand the advantages of this tax-friendly approach.

Another critical aspect that Sean emphasizes is the importance of having a well-defined written plan. Just like using navigation apps to chart a clear path when driving, individuals and families can greatly benefit from having a documented financial roadmap. While many rely on digital tools like Google Maps to guide their physical journeys, few take the time to develop and maintain a written plan for their financial well-being. This lack of intentional planning often leads to a state of merely getting by without a clear direction or strategy.

Sean strives to bring these overlooked areas to the forefront of everyday people’s awareness. By highlighting the tax advantages available to emerging entrepreneurs and promoting the adoption of written financial plans, he aims to empower individuals and families to make informed decisions, secure their financial future, and navigate the complexities of personal finance with confidence.

Guiding Business Owners and Pre-Retirees Towards Financial Success

In his role as a personal CFO, Sean envisions two distinct profiles as his ideal clients:

individuals who lead dual lives as business owners and family-oriented individuals, and pre-retirees seeking guidance on optimizing their retirement funds.

By addressing the unique challenges and opportunities faced by these two groups, Sean aims to provide personalized financial strategies that can lead to long-term success.

The first ideal client that Sean caters to is someone who juggles the demands of running their own business while also managing family obligations. These individuals require assistance in separating their personal and business finances, as well as implementing a comprehensive plan to align their financial goals with their current and future needs. By leveraging Sean’s expertise, these clients can streamline their financial affairs and gain clarity on the best strategies to protect and grow their wealth while nurturing their personal life.

Additionally, Sean identifies pre-retirees, particularly baby boomers with substantial 401k savings, as another key client group. Many of these individuals may find themselves uncertain about how to effectively utilize their retirement funds and capitalize on tax advantages as they approach retirement.

With his deep understanding of retirement planning and tax optimization, Sean is well-equipped to guide these clients through the complexities of transitioning from the accumulation phase to the distribution phase of their retirement savings, helping them make informed decisions that align with their financial objectives.

By specializing in these two client segments, Sean Hurdle offers invaluable support and strategic guidance, empowering business owners and pre-retirees to make sound financial decisions, protect their assets, and pave the way for a prosperous future.

Legacy and Preparation: Sean Hurdle’s Unique Perspective on Financial Planning

Sean Hurdle’s distinctive approach to financial planning stems from his upbringing within a family legacy of financial advisors. Being the son of a financial advisor allowed Sean to gain firsthand experience and knowledge about the importance of financial products and planning, which has shaped his professional path and set him apart in the industry.

An impactful moment in Sean’s life occurred during his youth when he accompanied his father on a solemn mission. They visited a client’s home to deliver a death benefits claim—a provision established by the family to provide financial support and leave a legacy for their loved ones. Contrary to Sean’s expectations of encountering grief-stricken individuals, he found a celebration of the departed person’s life. This experience profoundly impacted his perspective on the meaning of life, the significance of being prepared for life’s transitions, and the importance of cherishing each moment.

Through this firsthand encounter with the transformative power of financial planning, Sean gained a deep understanding of the emotional and practical impact it has on individuals and their families. It instilled in him a unique perspective on the intersection of financial preparedness and embracing the inevitable changes and challenges that life presents.

Drawing from his personal experience, Sean recognizes the value of planning for both the expected and unexpected events in life. He brings this empathetic and comprehensive approach to his clients, ensuring they have the necessary strategies in place to protect their loved ones, preserve their legacies, and navigate life’s transitions with confidence.

Sean Hurdle’s dedication to incorporating the lessons of legacy and preparation into his financial services distinguishes him as a compassionate and insightful advisor, capable of guiding his clients toward a secure and fulfilling financial future.

Navigating the Complexities of Life Insurance

When it comes to life insurance, Sean Hurdle possesses a wealth of knowledge and a passion for educating individuals about its significance. As a financial advisor, he emphasizes the importance of understanding the various types of life insurance and how they can benefit different individuals and families.

Sean firmly believes that every financial product serves a purpose and can be advantageous for specific situations. He cautions against dismissing any particular life insurance product without considering its potential value. In his experience, he has witnessed the pervasive misunderstandings surrounding life insurance, particularly among the middle-income community.

In Sean’s view, the key lies in recognizing that both term life insurance and permanent life insurance can have their merits and be suitable for different individuals depending on their unique needs, goals, and life stages. He emphasizes the importance of assessing one’s specific circumstances to determine which type of life insurance aligns best with their financial objectives.

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, offering protection during the policy term. On the other hand, permanent life insurance offers lifelong coverage and includes a cash value component that can accumulate over time. Sean understands that both options can play a vital role in securing financial stability and meeting long-term objectives.

Through his expertise, Sean guides his clients in navigating the complexities of life insurance, helping them understand the nuances and selecting the most appropriate coverage based on their unique circumstances. By debunking common misconceptions and tailoring solutions to individual needs, he empowers individuals and families to make informed decisions about life insurance and its potential benefits.

Overcoming Financial Challenges: Insights from Sean Hurdle’s Client Engagements

Sean Hurdle’s expertise in financial advisory services has provided him with valuable insights into the common situations and challenges faced by his clients. As he assists individuals and families in navigating their financial journeys, he encounters recurring themes that require careful attention and guidance.

One of the primary challenges Sean observes is the absence of a comprehensive written plan. Many individuals lack a clear roadmap for their financial goals and fail to adhere to a well-defined strategy. To overcome this obstacle, Sean emphasizes the importance of creating a written plan and encourages clients to establish realistic budgets that are both effective and enjoyable. By instilling discipline and practicality, he helps clients align their actions with their financial aspirations.

Saving habits present another prevalent challenge, particularly within the United States compared to other countries. Sean recognizes that saving is not ingrained in the American culture as strongly as it should be. Encouraging clients to set aside adequate funds for retirement and unforeseen circumstances proves to be a recurring hurdle. Through his guidance, Sean emphasizes the significance of building robust savings accounts, enabling clients to achieve financial security and resilience.

Additionally, Sean acknowledges that financial education often stems from employers, where it may be limited in scope. While employers provide resources such as 401(k) plans, Sean highlights the value of seeking guidance from dedicated financial professionals who possess comprehensive knowledge and experience. By consulting a financial advisor, individuals can gain a deeper understanding of various financial tools and strategies, allowing them to make more informed decisions regarding their wealth.

Sean Hurdle’s Insights on Common Mistakes

Within the realm of financial planning, Sean Hurdle has identified some significant missteps made by individuals, apart from the absence of a well-crafted plan. By shedding light on these mistakes, Sean aims to help his clients make informed decisions and optimize their financial strategies.

One prevalent error he often encounters is individuals acquiring life insurance without fully harnessing its living benefits. Sean emphasizes the importance of exploring options such as long-term care coverage and other living benefits that can provide support during one’s lifetime. By integrating these features into life insurance policies, individuals can leverage the full potential of their coverage and protect themselves against unforeseen circumstances.

Furthermore, Sean observes a lack of proactive tax planning among many individuals. While 401(k) plans and similar retirement funds are widely utilized, the potential tax implications are often overlooked. Sean advises diversifying retirement savings to mitigate future tax burdens, as he anticipates a likely increase in tax rates. By proactively preparing for potential tax hikes, individuals can safeguard their financial well-being and optimize their retirement strategies.

Sean’s approach challenges the conventional notion of deferring taxes without certainty regarding future rates. He advocates for overfunded life insurance, a concept also known as infinity banking, as a viable alternative. Through resources like Caleb Williams’ book “The And Asset” and David McKnight’s insightful publications, Sean encourages individuals to explore these strategies and tap into the advantages offered by overfunded life insurance. He notes that younger generations, such as Gen Z, are increasingly informed about these options, in contrast to their older counterparts.

Sean Hurdle’s Journey to Inspire 50,000 Lives

Driven by his desire to uplift and encourage others, Sean set an ambitious goal for himself: to have conversations with 50,000 people within a year.

Recognizing the need for a tangible reminder of these encounters, he devised a unique concept called the “anti-business card.” Rather than traditional contact information, this card features a simple phrase like “You Got This” on one side. When handed to someone, it serves as a powerful reminder of their inner strength and potential. Sean’s intention is to create a ripple effect of positivity and empowerment, even if the full impact may not be immediately visible.

To achieve his goal, Sean plans to create engaging content through on-the-street interactions. Inspired by popular videos where people share their stories and wisdom, he aims to capture the essence of human experiences.

Sean’s local community in Plymouth, Minnesota, particularly the affluent city of Minnetonka, presents an opportunity to engage with individuals from various backgrounds and learn about their accomplishments, dreams, and values. By connecting with people on a personal level, he hopes to spread encouragement and remind others of their worth.

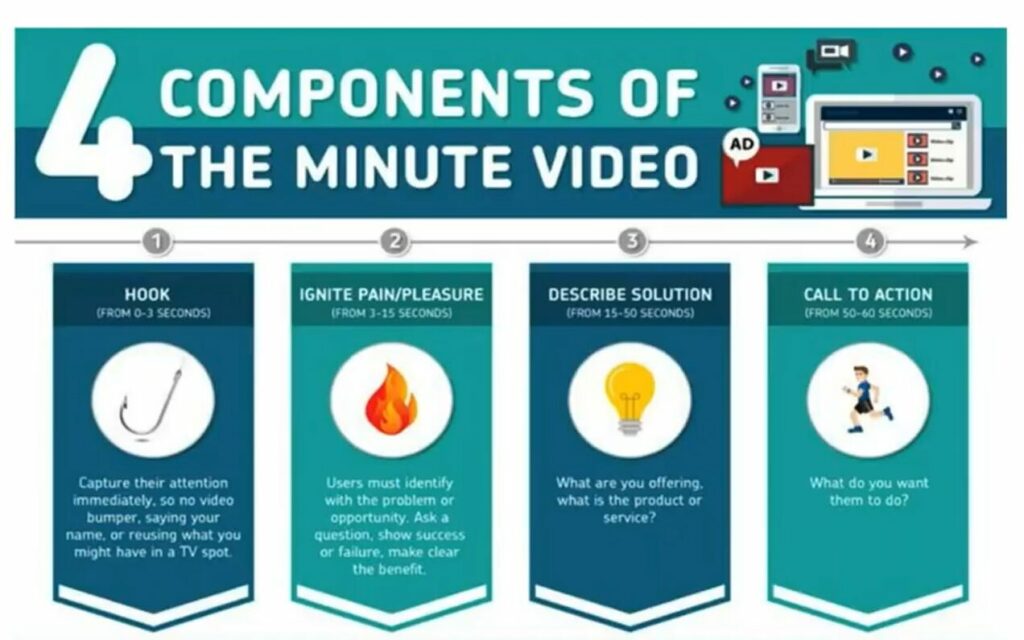

Building Community Connections through Captivating Videos

We discussed the importance of creating a series of captivating videos to become a recognizable figure in your local area and shed light on the importance of financial services.

Let’s look at an example.

Assume you are in Minnetonka. Interview local residents, focusing on elevating their stories, amplifying their voices, and validating their experiences. By sharing these videos, you will not only establish a stronger presence within the community but also fill the void of financial services awareness.

Harness the immense potential of social media platforms like TikTok and YouTube to maximize the impact of your videos. Utilize the short-form video format to create engaging content that resonates with viewers. By tapping into these platforms, you’ll be surprised by the reach and response your videos generate, further establishing your influence and presence in your local area.

Record your videos in diverse locations throughout Minnetonka. Whether it’s the popular Caribou Coffee, iconic local eateries, or even the renowned Mall of America near the airport, showcase your presence and experiences in these places. Frequent Minnetonka’s businesses and capture moments that reflect the authentic Minnetonka lifestyle. By immersing yourself in the community, you’ll cultivate a sense of familiarity and relatability with the viewers.

Ensure that your videos reach the right audience by implementing targeted advertising campaigns. Allocate a small budget, such as a dollar a day, to specifically target Minnetonka residents. By doing so, you will reach individuals who can identify with the places and experiences you showcase in your videos. This approach will foster a sense of connection, making you a friendly figure whom people can relate to and reach out to when they need someone to talk to or seek advice.

Go beyond the traditional role of a financial services provider by building authentic relationships with Minnetonka residents. Actively listen to their stories, validate their experiences, and provide support and encouragement. By becoming a trusted friend who genuinely cares, you’ll extend your ethos of giving and connecting with people. This approach will distinguish you from others solely focused on selling financial services, and people will view you as a compassionate confidant they can turn to in times of need.